Debt reduction strategies are essential for achieving financial well-being and securing a brighter future. Navigating the complexities of debt can be daunting, but understanding the different types of debt, their impact, and effective strategies for repayment can empower you to take control of your finances and break free from the shackles of debt.

This guide provides a comprehensive overview of debt reduction strategies, encompassing practical steps to assess your debt situation, develop a personalized plan, and manage your finances effectively. From understanding the psychological and financial consequences of high debt to exploring budgeting techniques, increasing income, and seeking professional guidance, this resource equips you with the knowledge and tools to embark on a successful journey towards debt freedom.

Understanding Debt and its Impact

Debt is a financial obligation that arises when an individual or entity borrows money from another party, promising to repay the borrowed amount with interest over a specified period. Understanding debt and its impact is crucial for managing personal finances effectively and achieving long-term financial goals.

Types of Debt and Their Characteristics

Different types of debt have unique characteristics that influence their impact on personal finances.

- Secured Debt:Secured debt is backed by collateral, an asset that the lender can claim if the borrower defaults on the loan. Examples include mortgages, auto loans, and some personal loans. The interest rates on secured debt are generally lower than unsecured debt due to the reduced risk for lenders.

- Unsecured Debt:Unsecured debt is not backed by collateral. Examples include credit cards, personal loans, and student loans. The interest rates on unsecured debt are typically higher than secured debt because lenders face greater risk of losing their money if the borrower defaults.

- Revolving Debt:Revolving debt is a type of credit that allows borrowers to repeatedly borrow and repay money within a set credit limit. Credit cards are the most common example of revolving debt. Borrowers can accrue interest on revolving debt if they do not pay their balance in full each month.

- Installment Debt:Installment debt involves borrowing a fixed amount of money and repaying it in regular installments over a predetermined period. Examples include auto loans, mortgages, and personal loans.

Psychological and Financial Consequences of High Debt Levels

High debt levels can have significant psychological and financial consequences.

- Stress and Anxiety:Carrying a large debt burden can lead to stress, anxiety, and feelings of overwhelm. This can negatively impact mental health and overall well-being.

- Limited Financial Flexibility:High debt obligations can limit financial flexibility, making it difficult to save for emergencies, invest, or pursue other financial goals.

- Reduced Credit Score:High debt utilization, or the percentage of available credit used, can negatively impact credit scores, making it more difficult to obtain loans or credit in the future.

- Financial Instability:High debt can lead to financial instability, making individuals vulnerable to financial shocks such as job loss or unexpected expenses.

Examples of Debt Hindering Financial Goals and Opportunities

High debt can hinder financial goals and opportunities in various ways.

- Saving for Retirement:A large debt burden can make it challenging to save for retirement, as a significant portion of income is directed towards debt repayment.

- Purchasing a Home:High debt levels can impact credit scores and reduce borrowing power, making it difficult to qualify for a mortgage or secure a favorable interest rate.

- Starting a Business:High debt can make it challenging to secure funding for a new business or increase the risk of failure due to limited financial resources.

- Investing in Education:High debt levels can make it difficult to afford further education or training, limiting career advancement opportunities.

Assessing Your Debt Situation

Before diving into specific debt reduction strategies, it’s crucial to understand the landscape of your current debt. This involves a thorough assessment of your financial obligations, including the types of debt, interest rates, and minimum payments. By gaining a clear picture of your debt situation, you can make informed decisions about your debt reduction journey.

Debt Inventory and Analysis

Creating a comprehensive list of all your outstanding debts is the first step. This includes credit cards, student loans, personal loans, auto loans, mortgages, and any other outstanding balances. For each debt, record the following information:

- Debt Type:This could include credit card debt, student loan debt, personal loan debt, etc.

- Creditor:This is the name of the company or institution you owe money to.

- Balance:This is the total amount of money you owe on the debt.

- Interest Rate:This is the percentage charged on your outstanding balance.

- Minimum Payment:This is the minimum amount you are required to pay each month.

Once you have compiled this information, you can begin to analyze your debt situation. One useful tool is the debt-to-income ratio (DTI), which measures your monthly debt payments as a percentage of your gross monthly income.

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

A high DTI can indicate financial strain, as a significant portion of your income is being used to service debt. A DTI of 43% or higher is considered a high risk for lenders, while a DTI of 36% or lower is generally considered healthy.

Identifying Opportunities for Negotiation

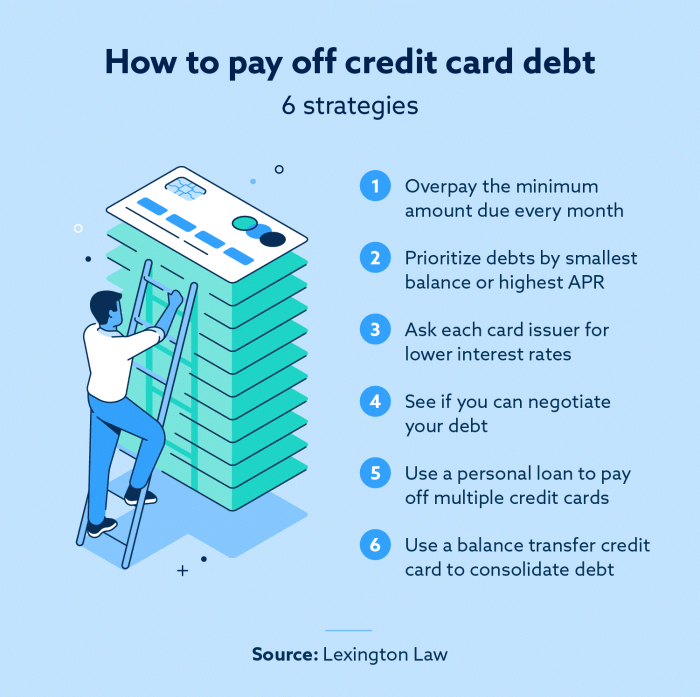

After compiling your debt inventory, you can start exploring opportunities to potentially lower your interest rates or payment terms.

- Contact Your Creditors:Reach out to your creditors and inquire about lower interest rates or more favorable payment terms. Many creditors are willing to work with borrowers who are struggling to manage their debt.

- Balance Transfer Offers:Consider transferring balances from high-interest credit cards to lower-interest credit cards or personal loans. This can save you money on interest charges and potentially reduce your minimum payments.

- Debt Consolidation:Explore debt consolidation options, which combine multiple debts into a single loan with a lower interest rate. This can simplify your debt management and potentially lower your monthly payments.

Analyzing Income and Expenses

Understanding your income and expenses is essential for developing a debt reduction plan. This involves tracking your income sources and categorizing your spending to identify areas where you can potentially save money.

- Income Sources:List all sources of income, including salary, wages, investments, and any other regular income streams.

- Expense Tracking:Keep a detailed record of your expenses for a month or two, using a budgeting app, spreadsheet, or a simple notebook. Categorize your expenses into different groups, such as housing, transportation, food, entertainment, and other miscellaneous expenses.

- Identifying Savings Opportunities:Once you have a clear picture of your income and expenses, you can identify areas where you can potentially reduce spending. This might include cutting back on non-essential expenses, negotiating lower rates for utilities or subscriptions, or finding ways to reduce transportation costs.

Developing a Debt Reduction Strategy

Once you have a clear understanding of your debt situation, it’s time to develop a strategic plan for tackling it. This involves choosing the right debt reduction method and creating a personalized plan that fits your financial circumstances.

Comparing Debt Reduction Methods

There are several popular debt reduction methods, each with its own advantages and disadvantages. Here are three common approaches:

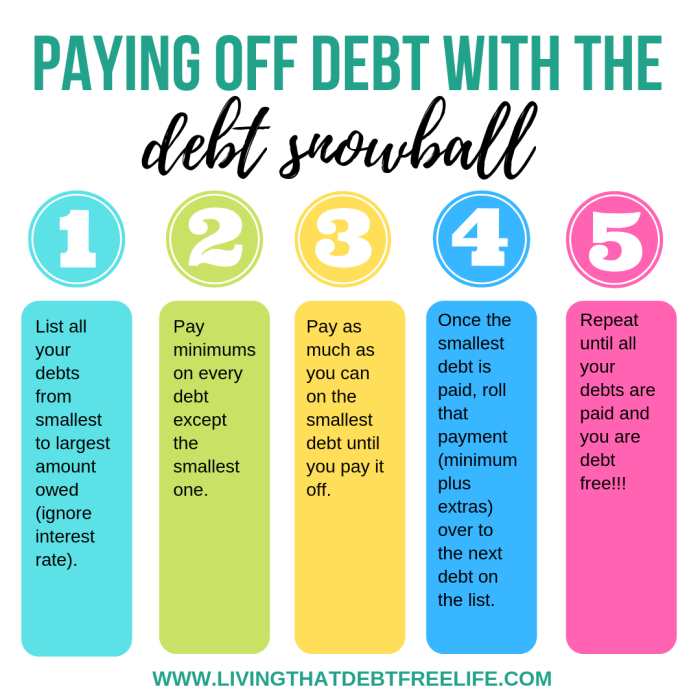

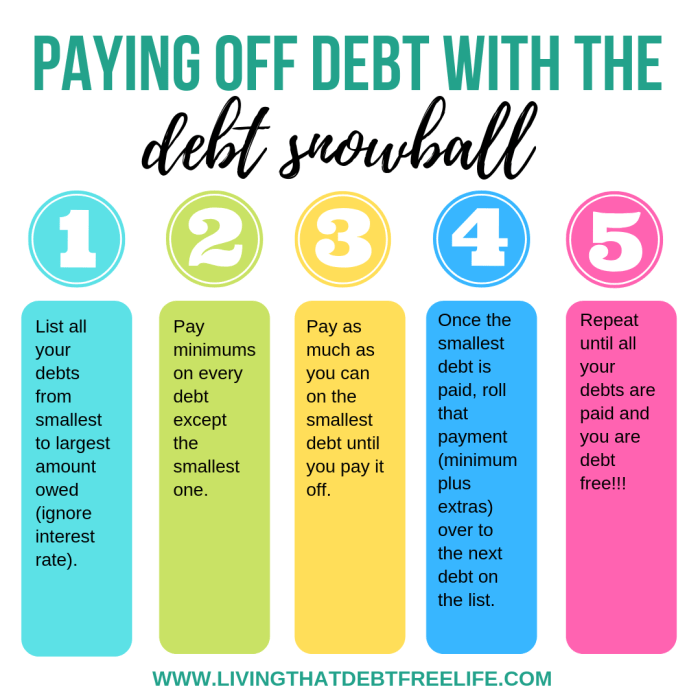

- Snowball Method:This method involves paying off your smallest debt first, regardless of interest rate. The satisfaction of quickly eliminating a debt can boost your motivation to continue. Once the smallest debt is paid off, you roll the payment amount onto the next smallest debt, creating a snowball effect.

- Avalanche Method:This method focuses on paying off the debt with the highest interest rate first. While it may take longer to see results, the avalanche method can save you significant money on interest charges in the long run.

- Debt Consolidation:This involves combining multiple debts into a single loan with a lower interest rate. This can simplify your payments and potentially save you money on interest, but it’s crucial to carefully consider the terms of the consolidation loan and ensure it’s truly beneficial.

Designing a Personalized Debt Reduction Plan

- Prioritize High-Interest Debt:The avalanche method is often recommended because it minimizes interest charges. However, the snowball method can be more motivating for some individuals, especially if they have several small debts with high interest rates.

- Create a Budget:A detailed budget helps you track your income and expenses, allowing you to identify areas where you can cut back and free up more money for debt repayment.

- Set Realistic Goals:Start with achievable goals to avoid feeling overwhelmed. Break down your debt reduction plan into smaller, manageable steps.

- Automate Payments:Set up automatic payments to ensure your debt payments are made on time and you don’t miss any due dates.

Staying Motivated and On Track

- Track Your Progress:Regularly monitor your debt balance and the amount of interest you’ve saved. Seeing your progress can keep you motivated.

- Celebrate Milestones:Reward yourself for reaching significant milestones in your debt reduction journey.

- Seek Support:Don’t hesitate to reach out to a financial advisor or a support group for guidance and encouragement.

Budgeting and Spending Control: Debt Reduction Strategies

Creating a realistic budget is crucial for effectively managing your finances and achieving your debt reduction goals. It helps you understand where your money goes and identify areas where you can cut back. By tracking your income and expenses, you can make informed decisions about your spending and allocate your resources wisely.

Creating a Realistic Budget

A budget is a financial plan that Artikels your income and expenses. It helps you track your spending and ensure that you are not overspending. A realistic budget reflects your actual income and expenses. Here are some steps to create a realistic budget:

- Track your income:Record all sources of income, including your salary, investments, and any other regular income streams.

- Track your expenses:Keep track of all your expenses, including fixed expenses like rent, utilities, and loan payments, as well as variable expenses like groceries, entertainment, and dining out.

- Categorize your expenses:Organize your expenses into categories, such as housing, transportation, food, and entertainment. This helps you see where your money is going and identify areas where you can cut back.

- Compare your income and expenses:Once you have tracked your income and expenses, compare the two to see if you are spending more than you earn. If you are, you need to find ways to reduce your expenses.

- Set financial goals:Determine your financial goals, such as paying off debt, saving for retirement, or buying a house. This will help you prioritize your spending and make informed financial decisions.

Reducing Unnecessary Spending

Once you have a clear picture of your spending habits, you can start identifying areas where you can reduce unnecessary expenses.

- Review subscriptions and memberships:Cancel any subscriptions or memberships you don’t use or that you can live without.

- Negotiate bills:Contact your service providers to negotiate lower rates for your phone, internet, or cable bills.

- Shop around for better deals:Compare prices for goods and services to find the best deals. Consider buying generic brands or using coupons to save money on groceries.

- Reduce dining out:Eating out frequently can be expensive. Try cooking more meals at home to save money.

- Cut back on entertainment:Entertainment expenses can add up quickly. Consider finding free or low-cost entertainment options, such as going for walks, attending free events, or borrowing books from the library.

Using Budgeting Tools and Apps

Budgeting tools and apps can help you track your spending, create budgets, and monitor your progress.

- Track spending:Budgeting tools and apps allow you to track your spending in real time, providing you with a clear picture of where your money is going.

- Create and manage budgets:These tools can help you create and manage budgets, set financial goals, and monitor your progress towards achieving them.

- Receive alerts and notifications:Many budgeting tools provide alerts and notifications when you are approaching your budget limits or when you have made significant purchases.

- Analyze your spending:Budgeting tools and apps can analyze your spending habits and identify areas where you can save money.

Increasing Income and Savings

Boosting your income and establishing strong savings habits are crucial for effectively tackling debt. By increasing your financial resources, you can accelerate your debt repayment journey and build a more secure financial future.

Increasing Income

Increasing your income can significantly accelerate your debt repayment efforts. Here are some potential ways to boost your earnings:

- Seek a Promotion or Raise:Explore opportunities for advancement within your current company. Demonstrate your value and skills to earn a promotion or negotiate a higher salary.

- Negotiate a Higher Salary:If you feel undervalued in your current role, consider negotiating a higher salary. Research industry benchmarks and prepare a compelling case to support your request.

- Explore Additional Work:Consider taking on a part-time job, freelance work, or consulting gigs to supplement your income. Many platforms offer flexible work arrangements, allowing you to work around your existing commitments.

- Develop New Skills:Investing in skill development can lead to higher earning potential. Online courses, workshops, or certifications can enhance your marketability and open up new career opportunities.

- Start a Side Hustle:Utilize your hobbies, passions, or skills to start a side hustle. Examples include selling crafts online, offering tutoring services, or starting a blog.

Establishing an Emergency Fund

An emergency fund serves as a safety net, providing financial stability during unexpected events. Here’s why it’s essential for debt reduction:

- Avoids Debt Accumulation:An emergency fund prevents you from relying on credit cards or loans to cover unexpected expenses, reducing the risk of further debt accumulation.

- Provides Financial Stability:A well-funded emergency fund helps you navigate unforeseen circumstances like job loss, medical emergencies, or car repairs without disrupting your debt repayment plan.

- Reduces Financial Stress:Knowing you have a financial cushion for emergencies reduces stress and allows you to focus on your debt reduction goals.

Building Savings Habits

Building strong savings habits is crucial for long-term financial security. Here are some tips to maximize your savings:

- Set Realistic Savings Goals:Define clear savings goals and break them down into smaller, achievable targets. For example, aim to save a specific percentage of your income each month.

- Automate Savings:Set up automatic transfers from your checking account to your savings account. This creates a consistent savings habit and ensures you don’t forget to save.

- Track Your Spending:Use budgeting apps or spreadsheets to monitor your spending habits. Identify areas where you can cut back and allocate those savings to your emergency fund.

- Prioritize Savings:Treat savings as a non-negotiable expense. Allocate a portion of your income to savings before paying other bills or making discretionary purchases.

Maximizing Savings

Smart investment strategies and tax-advantaged accounts can significantly boost your savings potential:

- Invest in Low-Cost Index Funds:Index funds track a specific market index, providing broad market exposure at a lower cost than actively managed funds. This is a suitable option for long-term growth.

- Consider a Roth IRA:A Roth IRA allows you to contribute after-tax dollars, which grow tax-free and withdrawals in retirement are tax-free. This is a great option for long-term savings and tax benefits.

- Explore Tax-Advantaged Accounts:Tax-advantaged accounts, such as 401(k)s and 403(b)s, offer tax benefits for retirement savings. Take advantage of employer matching contributions to maximize your returns.

Seeking Professional Guidance

Navigating debt reduction can be challenging, and sometimes seeking professional help can significantly benefit your journey. Financial advisors and credit counselors can provide valuable insights and support, helping you develop a personalized strategy and stay on track.

Benefits of Professional Guidance

- Customized Debt Reduction Plan:Financial advisors and credit counselors can assess your unique financial situation, including your income, expenses, and debt obligations. They can then create a tailored debt reduction plan that aligns with your goals and financial capacity.

- Objective Perspective:It can be difficult to remain objective when dealing with debt. Professionals can offer an unbiased perspective, helping you identify areas for improvement and make informed decisions without emotional bias.

- Negotiation Support:Debt professionals may be able to negotiate with creditors on your behalf, potentially securing lower interest rates, reduced monthly payments, or other favorable terms.

- Accountability and Support:Working with a professional can provide you with accountability and encouragement. They can help you stay motivated, track your progress, and address any challenges that arise along the way.

Finding Reputable Professionals, Debt reduction strategies

- National Foundation for Credit Counseling (NFCC):The NFCC is a non-profit organization that offers a directory of certified credit counselors. You can search for counselors in your area based on your specific needs.

- Financial Planning Association (FPA):The FPA is a professional organization for certified financial planners. You can use their website to find advisors in your area who specialize in debt management.

- National Association of Personal Financial Advisors (NAPFA):NAPFA is another professional organization that offers a directory of fee-only financial advisors. These advisors are compensated by their clients, not by commissions from product sales.

Maintaining Financial Health

Once you’ve successfully reduced your debt, it’s crucial to maintain your financial well-being and prevent falling back into debt. This involves monitoring your credit score, building positive credit history, avoiding debt traps, and developing healthy financial habits for the long term.

Credit Score Monitoring and Building Positive Credit History

Your credit score is a numerical representation of your creditworthiness, impacting your ability to access loans, credit cards, and even rental apartments. Monitoring your credit score regularly allows you to identify any errors or red flags that could negatively affect your score.

- Regularly check your credit report: Obtain your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) at least once a year for free through AnnualCreditReport.com. This allows you to identify any inaccuracies or suspicious activity.

- Dispute any errors: If you find any inaccuracies, dispute them with the credit bureau and the relevant creditor.

- Pay bills on time: Timely payments demonstrate your responsibility and contribute to a good credit history. Set reminders or use automatic payments to ensure consistent on-time payments.

- Use credit responsibly: Avoid maxing out your credit cards and maintain a low credit utilization ratio (the percentage of your available credit you’re using).

- Consider a secured credit card: If you have limited credit history, a secured credit card can help you build credit by requiring a security deposit.

Avoiding Debt Traps and Maintaining Financial Stability

Maintaining financial stability requires a proactive approach to avoid falling back into debt. Here are some strategies to prevent debt traps and maintain a healthy financial life:

- Avoid unnecessary spending: Create a realistic budget and stick to it. Track your expenses and identify areas where you can cut back on unnecessary spending.

- Resist impulsive purchases: Avoid making rash decisions and consider the long-term consequences of impulse purchases. Give yourself time to think before making significant purchases.

- Be wary of high-interest loans: Payday loans, cash advances, and other high-interest loans can quickly spiral into debt. Explore alternative options like personal loans or credit card balance transfers with lower interest rates.

- Avoid unnecessary credit applications: Every credit application can slightly lower your credit score. Only apply for credit when truly necessary.

- Develop a savings plan: Aim to save at least 3-6 months of living expenses as an emergency fund. This cushion can help you weather unexpected financial challenges without resorting to debt.

Impact of Debt Reduction on Overall Financial Well-being

Reducing debt has a significant impact on your overall financial well-being, freeing up more money for savings, investments, and achieving your financial goals.

- Reduced financial stress: Debt can be a significant source of stress and anxiety. Reducing debt can alleviate this stress and improve your overall mental and emotional well-being.

- Increased financial flexibility: With less debt, you have more financial flexibility to pursue your goals, such as buying a house, starting a business, or investing for retirement.

- Improved credit score: Paying down debt improves your credit score, making it easier to qualify for loans with better interest rates and access more financial products.

- Greater financial security: By reducing debt and building an emergency fund, you create a stronger financial foundation, providing greater security against unexpected financial shocks.

Conclusion

By implementing the strategies Artikeld in this guide, you can gain control of your finances, achieve peace of mind, and pave the way for a more secure and prosperous future. Remember, debt reduction is a journey, not a destination.

With dedication, perseverance, and a well-defined plan, you can overcome debt challenges and build a strong financial foundation for yourself and your loved ones.

Frequently Asked Questions

How long does it take to pay off debt?

The time it takes to pay off debt depends on factors such as the amount of debt, interest rates, and your repayment strategy. It’s crucial to create a realistic timeline and stick to your plan.

What if I can’t afford my minimum payments?

If you’re struggling to make minimum payments, contact your creditors immediately. They may be able to offer temporary relief or a payment plan.

Should I consolidate my debt?

Debt consolidation can be beneficial if it lowers your interest rate and simplifies your payments. However, ensure you understand the terms and conditions before consolidating.

Is it better to pay off high-interest debt first or the smallest debt?

Both the avalanche method (paying off high-interest debt first) and the snowball method (paying off the smallest debt first) have their advantages. Choose the method that motivates you and aligns with your financial goals.