Budgeting software reviews are essential for anyone seeking to take control of their finances. From tracking expenses and setting goals to analyzing spending patterns and generating insightful reports, these tools empower individuals and families to make informed financial decisions.

This guide explores the world of budgeting software, delving into its key features, benefits, and considerations for choosing the perfect option. We’ll analyze popular software options, highlighting their strengths and weaknesses, and provide valuable tips for using these tools effectively.

Introduction to Budgeting Software: Budgeting Software Reviews

Budgeting software is a valuable tool for individuals and families who want to take control of their finances. It helps users track income and expenses, set financial goals, and make informed decisions about their money. Budgeting software can be a game-changer for individuals and families who are looking to improve their financial health.

It provides a clear picture of your financial situation, allowing you to identify areas where you can save money or increase your income.

Types of Budgeting Software

Budgeting software comes in various forms, each with its own set of features and benefits.

- Spreadsheet-based budgeting software:This type of software uses spreadsheets to track income and expenses. It is a simple and affordable option, but it can be time-consuming to set up and maintain.

- Online budgeting software:Online budgeting software allows you to access your budget from any device with an internet connection. It typically offers more features than spreadsheet-based software, such as automatic transaction tracking, goal setting, and financial reports.

- Mobile budgeting apps:Mobile budgeting apps are designed for use on smartphones and tablets. They offer convenience and portability, allowing you to track your spending on the go.

Key Features of Budgeting Software

Budgeting software is designed to help you manage your finances effectively. It offers a range of features that simplify the budgeting process, track your spending, and provide insights into your financial health.

Essential Features of Budgeting Software

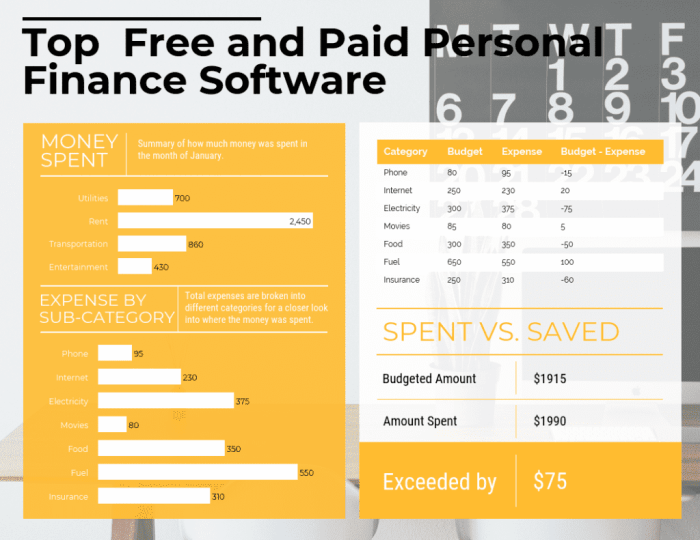

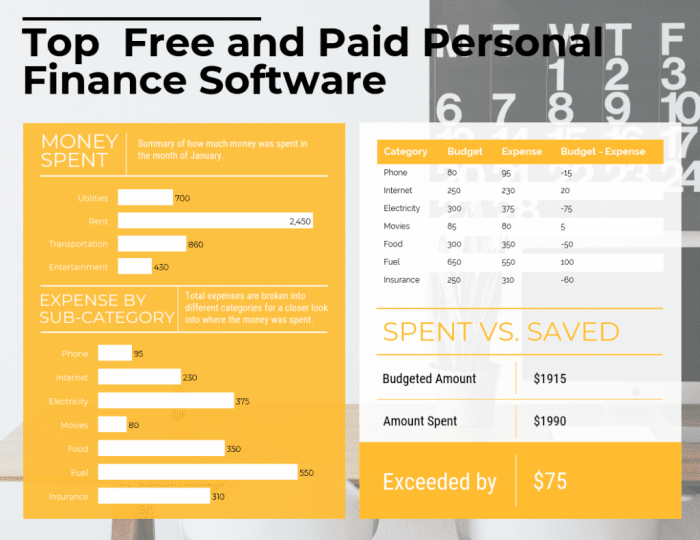

- Expense Tracking: Budgeting software allows you to track your income and expenses, providing a clear picture of your financial situation.

- Budgeting Tools: These tools help you create a budget by allocating your income to different categories, such as housing, food, transportation, and entertainment.

- Financial Reports: Budgeting software generates reports that summarize your spending, income, and net worth. These reports provide valuable insights into your financial performance.

- Goal Setting: You can set financial goals, such as saving for a down payment on a house or paying off debt, and track your progress towards achieving them.

- Account Aggregation: Some budgeting software allows you to connect your bank accounts, credit cards, and other financial accounts, automatically updating your transactions.

Comparison of Budgeting Software Features, Budgeting software reviews

| Software Name | Expense Tracking | Budgeting Tools | Financial Reports |

|---|---|---|---|

| Mint | Yes | Yes | Yes |

| YNAB (You Need a Budget) | Yes | Yes | Yes |

| Personal Capital | Yes | Yes | Yes |

| EveryDollar | Yes | Yes | Yes |

Categorization and Tracking of Expenses

Categorization and tracking of expenses are essential features of budgeting software. By categorizing your spending, you gain a deeper understanding of where your money goes. For example, you can categorize expenses as “Housing,” “Food,” “Transportation,” or “Entertainment.” This categorization allows you to identify areas where you might be overspending and make adjustments to your budget.

Goal Setting and Budgeting Tools

Goal setting and budgeting tools are crucial for achieving your financial objectives. These tools allow you to set specific, measurable, achievable, relevant, and time-bound (SMART) goals. You can then create a budget that aligns with your goals and track your progress towards achieving them.

Financial Reports and Insights

Financial reports and insights provide valuable information about your financial health. These reports summarize your spending, income, and net worth, highlighting areas for improvement. For instance, you can identify spending patterns, track your progress towards financial goals, and analyze your net worth over time.

Integration with Bank Accounts and Other Financial Tools

Integration with bank accounts and other financial tools streamlines the budgeting process. By connecting your accounts, budgeting software automatically updates your transactions, eliminating the need for manual entry. This integration also allows you to track your investments, analyze your credit score, and manage your debt.

Choosing the Right Budgeting Software

Choosing the right budgeting software is crucial for effective financial management. With numerous options available, it’s essential to carefully consider your needs and preferences before making a decision.

Factors to Consider

When selecting budgeting software, several factors should be taken into account to ensure it aligns with your financial goals and usage habits.

- Budgeting Method:Different software programs utilize various budgeting methods. Some focus on the 50/30/20 rule, while others employ zero-based budgeting or other approaches. Choose a method that aligns with your financial philosophy and preferences.

- Features:Budgeting software offers a range of features, including expense tracking, bill payment reminders, goal setting, investment tracking, and financial reporting. Evaluate the features offered by each software and prioritize those that are most relevant to your needs.

- Ease of Use:The software should be user-friendly and intuitive. Consider the interface, navigation, and overall ease of data input and analysis. Look for programs that provide clear instructions and tutorials.

- Mobile App Availability:Accessing your budget on the go is crucial for many users. Ensure the software has a mobile app that is compatible with your device and offers the necessary features for convenient budgeting.

- Security:Your financial data is sensitive, so choose software that prioritizes security. Look for programs that use encryption and other security measures to protect your information.

- Pricing:Budgeting software comes in various price ranges, from free to premium subscription models. Consider your budget and the features offered at different price points.

- Customer Support:Reliable customer support is essential for resolving any issues or questions you may encounter. Evaluate the availability and responsiveness of customer support channels, such as email, phone, or live chat.

Tips for Evaluating Software Options

Evaluating different software options can be overwhelming. To streamline the process, consider the following tips:

- Read Reviews:Check online reviews from other users to gain insights into the software’s strengths and weaknesses. Look for reviews that provide detailed information about the user experience, features, and customer support.

- Trial Periods:Many budgeting software providers offer free trial periods. Take advantage of these trials to test the software and see if it meets your needs before committing to a subscription.

- Compare Features:Create a list of essential features you require in budgeting software. Compare the features offered by different programs and choose the one that best aligns with your needs.

- Consider Your Financial Goals:Think about your financial goals and choose software that supports them. For example, if you’re saving for a down payment, look for software with goal-setting features.

Choosing the Best Budgeting Software

Follow these steps to choose the best budgeting software for your financial needs:

- Identify Your Needs:Determine your budgeting goals, preferences, and the features you require. For example, if you need to track investments, prioritize software with investment tracking features.

- Research Software Options:Explore different budgeting software programs and read reviews from other users. Pay attention to features, ease of use, security, pricing, and customer support.

- Take Advantage of Trial Periods:Try out several software options using free trial periods to experience their functionalities firsthand. This allows you to assess their user interface, data input methods, and overall usability.

- Compare and Contrast:Create a table or spreadsheet to compare the features, pricing, and other aspects of different software programs. This will help you identify the best fit for your needs and budget.

- Make Your Decision:Choose the budgeting software that best aligns with your requirements, preferences, and financial goals. Ensure it offers the necessary features, is user-friendly, and provides reliable customer support.

Popular Budgeting Software Reviews

Choosing the right budgeting software can be a daunting task, with numerous options available, each with its own set of features and benefits. To help you make an informed decision, we’ve compiled a list of popular budgeting software options, providing an overview of their features, user reviews, pricing, and strengths and weaknesses.

Popular Budgeting Software Options

Here are some of the most popular budgeting software options available, categorized based on their strengths and target user base:

- For Beginners:These options are user-friendly, with intuitive interfaces and basic features ideal for those new to budgeting.

- For Advanced Users:These options offer a wider range of features, including advanced reporting, investment tracking, and goal setting, catering to experienced budgeters.

- For Couples or Families:These options allow multiple users to access and manage the budget together, making it easier for families or couples to collaborate.

Mint

Mint is a popular budgeting software that provides a comprehensive overview of your finances. It automatically categorizes your transactions, tracks your spending, and helps you set budgets and financial goals. Mint also offers features such as bill reminders, credit score monitoring, and investment tracking.

- Key Features:Automatic transaction categorization, spending tracking, budgeting, financial goals, bill reminders, credit score monitoring, investment tracking.

- User Reviews:Mint has received generally positive reviews, with users praising its user-friendliness, comprehensive features, and helpful insights. However, some users have reported issues with account connectivity and data accuracy.

- Pricing:Mint is free to use.

- Strengths:User-friendly interface, comprehensive features, free to use.

- Weaknesses:Potential issues with account connectivity and data accuracy.

YNAB (You Need a Budget)

YNAB is a budgeting software that emphasizes a “give every dollar a job” approach, encouraging users to allocate every dollar of their income to a specific purpose. It provides a clear visual representation of your finances, helping you make informed spending decisions and achieve your financial goals.

- Key Features:Budget planning, spending tracking, goal setting, debt management, investment tracking.

- User Reviews:YNAB has received overwhelmingly positive reviews, with users praising its effectiveness in helping them gain control of their finances and achieve their financial goals. Some users have mentioned that the software can be initially challenging to learn, but the benefits are worth the effort.

- Pricing:YNAB offers a free 34-day trial, followed by a monthly subscription fee.

- Strengths:Effective budgeting methodology, clear visual representation of finances, comprehensive features.

- Weaknesses:Subscription fee, potentially steep learning curve.

Personal Capital

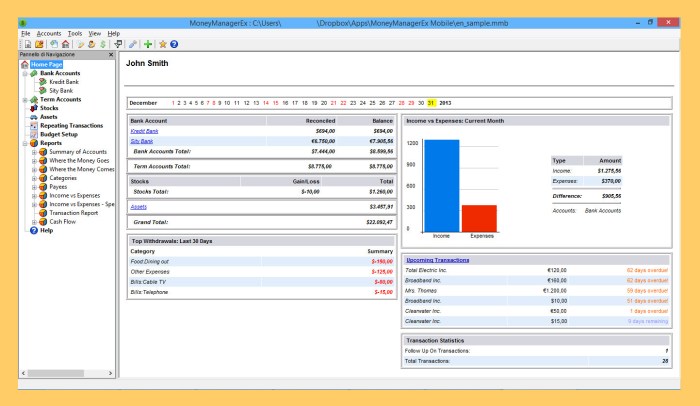

Personal Capital is a financial management platform that offers a comprehensive suite of budgeting and investment tools. It aggregates your accounts, tracks your spending, provides investment insights, and offers financial planning advice.

- Key Features:Account aggregation, spending tracking, investment analysis, financial planning advice, retirement planning tools.

- User Reviews:Personal Capital has received positive reviews, with users appreciating its comprehensive features, investment insights, and free access to financial planning advice. However, some users have reported issues with the platform’s performance and user interface.

- Pricing:Personal Capital is free to use for its basic features. Advanced features, such as financial planning advice, come with a fee.

- Strengths:Comprehensive features, investment insights, free access to financial planning advice.

- Weaknesses:Potential performance issues, user interface could be improved.

EveryDollar

EveryDollar is a budgeting software that focuses on a zero-based budgeting approach, where every dollar of your income is allocated to a specific category. It provides a simple and straightforward interface, making it easy for users to create and manage their budgets.

- Key Features:Zero-based budgeting, spending tracking, bill reminders, debt management.

- User Reviews:EveryDollar has received positive reviews, with users praising its simplicity, affordability, and effectiveness in helping them stick to their budgets. Some users have mentioned that the software lacks advanced features, such as investment tracking and financial planning advice.

- Pricing:EveryDollar offers a free basic plan, as well as a paid premium plan with additional features.

- Strengths:Simple and straightforward interface, affordable, effective zero-based budgeting approach.

- Weaknesses:Limited advanced features, such as investment tracking and financial planning advice.

PocketGuard

PocketGuard is a budgeting app that helps you manage your spending and avoid overspending. It analyzes your spending habits, provides personalized recommendations, and helps you set financial goals. PocketGuard also offers features such as bill reminders, debt management, and savings goals.

- Key Features:Spending tracking, personalized recommendations, financial goal setting, bill reminders, debt management, savings goals.

- User Reviews:PocketGuard has received positive reviews, with users praising its user-friendliness, helpful insights, and effectiveness in helping them manage their spending. Some users have mentioned that the app can be intrusive with its notifications and that it lacks advanced features, such as investment tracking.

- Pricing:PocketGuard offers a free basic plan, as well as a paid premium plan with additional features.

- Strengths:User-friendly interface, personalized recommendations, effective spending management.

- Weaknesses:Intrusive notifications, limited advanced features.

Summary Table

| Software Name | Key Features | Pros | Cons |

|---|---|---|---|

| Mint | Automatic transaction categorization, spending tracking, budgeting, financial goals, bill reminders, credit score monitoring, investment tracking. | User-friendly interface, comprehensive features, free to use. | Potential issues with account connectivity and data accuracy. |

| YNAB | Budget planning, spending tracking, goal setting, debt management, investment tracking. | Effective budgeting methodology, clear visual representation of finances, comprehensive features. | Subscription fee, potentially steep learning curve. |

| Personal Capital | Account aggregation, spending tracking, investment analysis, financial planning advice, retirement planning tools. | Comprehensive features, investment insights, free access to financial planning advice. | Potential performance issues, user interface could be improved. |

| EveryDollar | Zero-based budgeting, spending tracking, bill reminders, debt management. | Simple and straightforward interface, affordable, effective zero-based budgeting approach. | Limited advanced features, such as investment tracking and financial planning advice. |

| PocketGuard | Spending tracking, personalized recommendations, financial goal setting, bill reminders, debt management, savings goals. | User-friendly interface, personalized recommendations, effective spending management. | Intrusive notifications, limited advanced features. |

Tips for Using Budgeting Software Effectively

Budgeting software can be a powerful tool for managing your finances, but it’s important to use it effectively to maximize its benefits. Here are some tips for getting the most out of your budgeting software.

Setting Up Your Budget

It’s crucial to set up your budget correctly to ensure accurate tracking and analysis.

- Start by categorizing your income and expenses.This helps you understand where your money is coming from and where it’s going. Common categories include income, housing, transportation, food, entertainment, and savings.

- Set realistic goals for your spending and savings.Consider your income, expenses, and financial goals when setting these targets.

- Use the software’s features to track your spending.Most budgeting software allows you to track your spending manually or automatically by linking your bank accounts.

Managing Your Budget

Once you’ve set up your budget, it’s important to manage it effectively to stay on track.

- Review your budget regularly.Aim to review your budget at least monthly to track your progress and make adjustments as needed.

- Make adjustments to your budget based on your spending patterns.If you’re consistently overspending in a particular category, you may need to reduce your spending in that area or increase your income.

- Use the software’s reporting features to analyze your spending.This can help you identify areas where you can save money or make adjustments to your budget.

Tracking Expenses

Tracking your expenses is essential for understanding your spending patterns and making informed financial decisions.

- Use the software’s tools to track your expenses.This can include manually entering transactions or connecting your bank accounts for automatic tracking.

- Categorize your expenses.This helps you see where your money is going and identify areas where you can cut back.

- Set spending limits for each category.This can help you stay on track with your budget and avoid overspending.

Analyzing Spending Patterns

Analyzing your spending patterns can help you identify areas where you can save money and make informed financial decisions.

- Use the software’s reporting features to generate spending reports.This can show you your spending by category, time period, and other criteria.

- Identify areas where you can cut back.Look for areas where you’re overspending or where you can find cheaper alternatives.

- Use the data to make informed financial decisions.For example, if you see that you’re consistently overspending on dining out, you might decide to cook at home more often.

Making Informed Financial Decisions

Budgeting software can help you make informed financial decisions by providing insights into your spending and helping you track your progress toward your goals.

- Use the software’s goal-setting features to track your progress.This can help you stay motivated and on track.

- Make adjustments to your budget as needed.Life is unpredictable, so be prepared to make adjustments to your budget as your circumstances change.

- Use the software’s tools to simulate different financial scenarios.This can help you make informed decisions about your finances.

Budgeting Software for Different Needs

Budgeting software is not a one-size-fits-all solution. Different individuals, families, and businesses have unique financial needs and goals. Therefore, choosing the right budgeting software depends on your specific requirements.

Budgeting Software for Individuals

Individuals often use budgeting software to track their income and expenses, set financial goals, and manage their debt. Some popular budgeting software options for individuals include:

- YNAB (You Need a Budget):YNAB is a popular budgeting software that emphasizes the “zero-based budgeting” method. It encourages users to allocate every dollar of their income to a specific purpose, leaving no room for unplanned spending.

- Mint:Mint is a free budgeting software that connects to your bank accounts and credit cards to automatically track your transactions. It provides insights into your spending habits and offers personalized financial advice.

- Personal Capital:Personal Capital is a free budgeting software that offers a comprehensive suite of financial tools, including investment tracking, retirement planning, and net worth monitoring.

Budgeting Software for Families

Families often require budgeting software that can accommodate multiple users and shared accounts. They may also need features for tracking family expenses, creating budgets for different household needs, and managing joint financial goals.

- EveryDollar:EveryDollar is a budgeting software based on the “envelope system,” where you allocate a set amount of money to different spending categories. It offers a family-friendly interface and allows multiple users to access the same budget.

- PocketGuard:PocketGuard is a budgeting software that helps families stay on track with their spending by setting spending limits and providing real-time alerts when they are close to exceeding their budgets.

- Honeydue:Honeydue is a budgeting software designed specifically for couples. It helps couples manage their finances together, track shared expenses, and set financial goals as a team.

Budgeting Software for Small Businesses

Small businesses need budgeting software that can handle complex financial transactions, track inventory, generate reports, and manage cash flow.

- Xero:Xero is a cloud-based accounting software that offers a range of features for small businesses, including budgeting, invoicing, and payroll.

- QuickBooks Self-Employed:QuickBooks Self-Employed is a popular accounting software designed specifically for freelancers and small business owners. It simplifies expense tracking, invoicing, and tax preparation.

- FreshBooks:FreshBooks is a cloud-based accounting software that offers a wide range of features for small businesses, including budgeting, invoicing, expense tracking, and time tracking.

Table of Budgeting Software Options for Different Needs

| User Type | Software Name | Key Features | Pricing |

|---|---|---|---|

| Individuals | YNAB (You Need a Budget) | Zero-based budgeting, goal setting, debt management | $14.99 per month |

| Individuals | Mint | Automatic transaction tracking, spending analysis, financial advice | Free |

| Individuals | Personal Capital | Investment tracking, retirement planning, net worth monitoring | Free |

| Families | EveryDollar | Envelope system budgeting, multiple user access, family-friendly interface | $14.99 per month |

| Families | PocketGuard | Spending limits, real-time alerts, budget tracking | Free (with limited features) or $7.99 per month |

| Families | Honeydue | Joint budgeting, shared expense tracking, financial goal setting | Free (with limited features) or $12.99 per month |

| Small Businesses | Xero | Budgeting, invoicing, payroll, expense tracking | Starts at $35 per month |

| Small Businesses | QuickBooks Self-Employed | Expense tracking, invoicing, tax preparation | $15 per month |

| Small Businesses | FreshBooks | Budgeting, invoicing, expense tracking, time tracking | Starts at $15 per month |

Final Summary

Ultimately, the best budgeting software is the one that aligns with your individual needs and preferences. By understanding the features, benefits, and considerations discussed in this guide, you can confidently choose a tool that empowers you to achieve your financial goals and make informed decisions about your money.

Helpful Answers

Is budgeting software only for people with low incomes?

No, budgeting software can benefit anyone, regardless of their income level. It helps you understand your spending habits, set financial goals, and make informed decisions about your money, regardless of your income.

How secure is my financial data when using budgeting software?

Reputable budgeting software providers prioritize data security. They use encryption, two-factor authentication, and other measures to protect your financial information. However, it’s essential to research the software’s security measures and choose a provider with a strong track record.

Is it difficult to learn how to use budgeting software?

Most budgeting software is designed to be user-friendly and intuitive. Many offer tutorials, support resources, and interactive guides to help you get started. You can also find numerous online resources and communities dedicated to helping users master budgeting software.