Best personal finance apps are transforming how we manage our finances. These powerful tools offer a wide range of features, from budgeting and expense tracking to investment management and financial education. By leveraging technology, personal finance apps empower individuals to gain insights into their spending habits, make informed financial decisions, and achieve their financial goals.

From tracking every dollar spent to setting up automated savings plans, these apps simplify complex financial tasks and provide valuable resources for building a secure financial future. Whether you’re a seasoned investor or just starting to manage your money, a well-chosen personal finance app can be a game-changer.

Introduction to Personal Finance Apps

Personal finance apps have gained immense popularity in recent years, becoming an essential tool for individuals seeking to manage their finances effectively. These apps provide a convenient and user-friendly platform for tracking expenses, budgeting, investing, and achieving financial goals.The benefits of using personal finance apps extend beyond mere convenience.

They empower individuals to take control of their finances, make informed financial decisions, and achieve financial well-being.

Types of Personal Finance Apps

Personal finance apps cater to a wide range of financial needs and preferences. They can be broadly categorized into several types:

- Budgeting Apps:These apps help users track their income and expenses, create budgets, and monitor spending patterns. Popular examples include Mint, Personal Capital, and YNAB (You Need a Budget).

- Expense Tracking Apps:These apps focus on recording and categorizing transactions, providing insights into spending habits. Examples include Expensify, and PocketGuard.

- Investing Apps:These apps allow users to invest in stocks, bonds, mutual funds, and other financial instruments. Popular examples include Robinhood, Acorns, and Stash.

- Debt Management Apps:These apps assist users in managing and paying off debt, such as credit cards and loans. Examples include Credit Karma, and Debt.com.

- Financial Planning Apps:These apps offer comprehensive financial planning tools, including retirement planning, college savings, and insurance needs. Examples include Personal Capital, and Betterment.

Key Features of Personal Finance Apps

Personal finance apps are designed to simplify money management and empower individuals to make informed financial decisions. These apps offer a wide range of features that cater to various financial needs, from budgeting and expense tracking to investment management and financial education.

Budgeting Tools

Budgeting tools are a cornerstone of effective personal finance management. They help users create a spending plan, track income and expenses, and identify areas where they can save money.

- Budgeting Templates:Many apps provide pre-designed budget templates based on income levels, expenses, and financial goals. These templates offer a starting point for users to create a customized budget.

- Expense Categorization:Personal finance apps automatically categorize expenses based on merchant information, making it easy to track spending by category (e.g., food, housing, entertainment).

- Budgeting Visualization:Apps use charts, graphs, and visual representations to provide insights into spending patterns and budget adherence. This helps users understand their financial situation better and make adjustments as needed.

Expense Tracking, Best personal finance apps

Expense tracking is a crucial aspect of personal finance management. It involves recording all income and expenses to gain a clear picture of cash flow and spending habits.

- Manual Entry:Most apps allow users to manually enter expenses, either through a simple interface or by connecting bank accounts.

- Automatic Synchronization:Some apps connect to bank accounts and credit card accounts, automatically importing transaction data. This eliminates the need for manual entry and ensures accurate expense tracking.

- Transaction Categorization:Apps automatically categorize expenses, providing insights into spending patterns. This allows users to identify areas where they can reduce spending or allocate funds more effectively.

Goal Setting and Saving

Goal setting and saving features help users plan for future financial goals, such as buying a house, paying off debt, or saving for retirement.

- Goal Definition:Users can set specific financial goals, including the target amount, timeline, and desired interest rate.

- Saving Targets:Apps calculate the amount needed to save each month to reach the goal within the specified timeframe.

- Progress Tracking:Users can monitor their progress towards their goals and adjust their saving strategies as needed.

Investment Tracking and Portfolio Management

Investment tracking and portfolio management features allow users to monitor their investments, analyze performance, and make informed investment decisions.

- Investment Tracking:Apps can track investments across various accounts, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- Portfolio Performance Analysis:Apps provide insights into portfolio performance, including returns, risk levels, and asset allocation.

- Investment Recommendations:Some apps offer personalized investment recommendations based on individual risk tolerance, financial goals, and market conditions.

Financial Education Resources and Tools

Personal finance apps often include educational resources and tools to help users improve their financial literacy.

- Articles and Blogs:Apps provide access to articles, blog posts, and other educational content covering various personal finance topics, such as budgeting, saving, investing, and debt management.

- Financial Calculators:Apps offer calculators to help users estimate loan payments, retirement savings, and investment returns.

- Personalized Insights:Some apps provide personalized financial advice based on individual circumstances and goals.

Popular Personal Finance Apps: Best Personal Finance Apps

The world of personal finance apps is vast and diverse, offering a range of features and functionalities to help users manage their money effectively. These apps have become increasingly popular as they provide convenient and accessible tools for budgeting, saving, investing, and tracking expenses.

Popular Personal Finance Apps

Personal finance apps have gained significant popularity, offering a wide range of features to manage finances effectively. Here is a table comparing some of the most popular apps:

| App Name | Key Features | Pros | Cons |

|---|---|---|---|

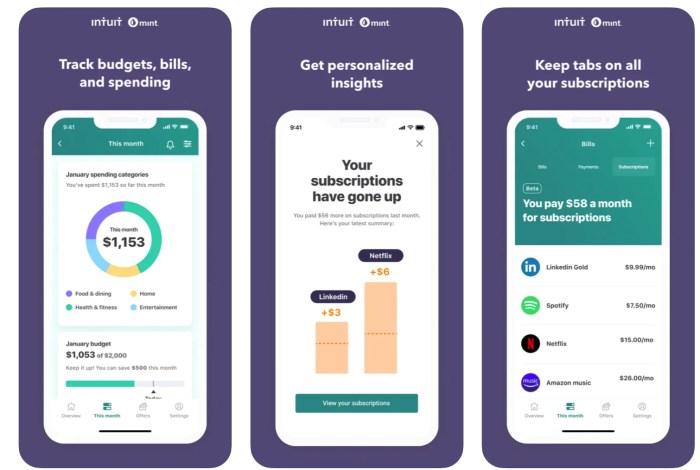

| Mint | Budgeting, expense tracking, bill payment, credit monitoring, investment tracking | User-friendly interface, comprehensive features, free to use | Limited investment analysis, can be slow to update, privacy concerns |

| Personal Capital | Budgeting, expense tracking, investment management, retirement planning, net worth tracking | Advanced investment analysis, free for most features, strong security | Limited bill payment options, can be overwhelming for beginners |

| YNAB (You Need a Budget) | Budgeting, expense tracking, debt management, goal setting | Emphasis on budgeting principles, effective debt management tools, strong community support | Paid subscription required, steep learning curve, limited investment tracking |

| EveryDollar | Budgeting, expense tracking, debt management, goal setting | Based on the “zero-based budgeting” method, easy to use, free for basic features | Limited investment tracking, some features require a paid subscription |

| PocketGuard | Budgeting, expense tracking, debt management, goal setting | User-friendly interface, automatic expense categorization, personalized insights | Limited investment tracking, some features require a paid subscription, can be intrusive |

Comparison of Top 5 Personal Finance Apps

The top 5 personal finance apps, Mint, Personal Capital, YNAB, EveryDollar, and PocketGuard, offer a range of features and benefits. * Mint:This app is popular for its comprehensive suite of features, including budgeting, expense tracking, bill payment, credit monitoring, and investment tracking.

It is free to use, making it accessible to a wide audience. However, its investment analysis features are limited, and it can be slow to update transactions.* Personal Capital:This app focuses on investment management and retirement planning, providing advanced analysis and tools for managing investments.

It is free for most features, making it an attractive option for investors. However, its bill payment options are limited, and its interface can be overwhelming for beginners.* YNAB:This app emphasizes the “zero-based budgeting” method, which involves allocating every dollar to a specific purpose.

It is effective for managing debt and setting financial goals. However, it requires a paid subscription, and its learning curve can be steep.* EveryDollar:This app is based on the “zero-based budgeting” method, providing a simple and easy-to-use interface for budgeting and expense tracking.

It is free for basic features, but some advanced features require a paid subscription. Its investment tracking features are limited.* PocketGuard:This app focuses on budgeting and expense tracking, providing a user-friendly interface with automatic expense categorization and personalized insights. It offers a free version with limited features, but a paid subscription unlocks more advanced functionality.

It can be intrusive, requiring access to financial accounts.

Choosing the Right Personal Finance App

Navigating the vast world of personal finance apps can be overwhelming. With so many options available, finding the perfect app for your needs requires careful consideration and a strategic approach. This guide will walk you through the process of selecting the best personal finance app for your unique financial journey.

Evaluating App Features and Functionalities

It is crucial to evaluate the features and functionalities of different apps to determine if they align with your personal financial goals.

- Budgeting and Tracking:The app should allow you to easily track your income and expenses, categorize transactions, and create budgets. Look for features like automatic transaction categorization, budget alerts, and spending reports.

- Goal Setting and Saving:The app should provide tools for setting financial goals, such as saving for a down payment, retirement, or a vacation. Features like goal-specific savings accounts, progress tracking, and automated savings can be beneficial.

- Investing and Portfolio Management:If you’re interested in investing, the app should offer investment tracking, portfolio analysis, and research tools. Look for features like real-time market data, investment recommendations, and fractional share investing.

- Debt Management:The app should provide tools for managing debt, such as tracking loan balances, interest rates, and minimum payments. Features like debt snowball calculators, debt payoff trackers, and debt consolidation tools can be helpful.

- Credit Monitoring and Reporting:The app should provide access to your credit score and report, allowing you to monitor your credit health. Features like credit score simulations, credit utilization tracking, and credit monitoring alerts can be valuable.

- Bill Payment and Reminders:The app should allow you to pay bills directly from the app and set reminders for upcoming payments. Look for features like automatic bill payments, bill negotiation tools, and bill tracking.

- Financial Education and Insights:The app should offer financial education resources, such as articles, videos, and calculators, to help you improve your financial literacy. Features like personalized financial advice, spending analysis, and financial goal suggestions can be beneficial.

Considering User Interface, Security, and Customer Support

The user interface, security, and customer support are crucial factors to consider when choosing a personal finance app.

- User Interface:The app should be user-friendly and intuitive, with a clear and organized layout. Look for features like customizable dashboards, easy navigation, and visually appealing graphics. A good user interface makes it easier to manage your finances and stay engaged with the app.

- Security:Your financial data is sensitive, so it’s essential to choose an app with robust security measures. Look for features like multi-factor authentication, encryption, and data backups. The app should also comply with industry standards and regulations to protect your information.

- Customer Support:It’s important to have access to reliable customer support if you encounter any issues or have questions. Look for apps that offer multiple support channels, such as email, phone, and live chat. The app should also have comprehensive FAQs and help documentation.

Determining the Best App Based on Individual Needs and Financial Goals

The best personal finance app for you will depend on your specific needs and financial goals.

- Financial Goals:Consider your short-term and long-term financial goals. If you’re saving for a down payment, you might prioritize an app with goal-specific savings accounts and budgeting tools. If you’re interested in investing, you might prefer an app with investment tracking and portfolio analysis features.

- Financial Habits:Think about your current financial habits and what you need help with. If you struggle with budgeting, you might choose an app with robust budgeting features. If you’re prone to overspending, you might look for an app with spending alerts and spending analysis tools.

- Tech Savviness:Consider your level of tech savviness. If you’re not comfortable with complex apps, you might prefer a simple and intuitive app. If you’re comfortable with advanced features, you might choose an app with more advanced functionalities.

- Budget:Some personal finance apps offer free versions, while others require a subscription. Consider your budget and choose an app that fits your financial situation.

Tips for Using Personal Finance Apps Effectively

Personal finance apps are powerful tools that can help you take control of your finances, but their effectiveness depends on how you use them. To maximize their benefits, it’s crucial to implement strategies that align with your financial goals and habits.

Setting Realistic Financial Goals and Tracking Progress

Setting clear and achievable financial goals is essential for staying motivated and on track. Personal finance apps can help you define your goals, break them down into smaller steps, and monitor your progress.

- Define Specific Goals:Instead of vague goals like “save more money,” specify the amount you want to save and the timeframe. For example, “Save $5,000 in 12 months for a down payment on a car.”

- Track Progress Regularly:Regularly check your app to see how you’re progressing towards your goals. This will help you identify areas where you need to adjust your spending or saving habits.

- Visualize Progress:Many apps offer charts and graphs that visually represent your progress, making it easier to stay motivated and see the positive impact of your efforts.

Creating and Sticking to a Budget

Budgeting is the foundation of sound financial management. Personal finance apps streamline the budgeting process, helping you track your income and expenses, identify areas for improvement, and stay within your spending limits.

- Categorize Expenses:Categorize your expenses to gain insights into where your money is going. This can help you identify areas where you can cut back or reallocate funds.

- Set Spending Limits:Allocate specific amounts to different expense categories based on your priorities. Apps can help you stay within these limits by providing alerts when you’re approaching your spending cap.

- Analyze Spending Trends:Use your app’s analytics features to identify spending patterns and trends. This can reveal areas where you might be overspending or underutilizing your resources.

Automating Savings and Investments

Automating your savings and investments is a key strategy for building wealth over time. Personal finance apps can facilitate this process by allowing you to set up recurring transfers and investments.

- Set Up Automatic Transfers:Schedule regular transfers from your checking account to your savings account. This ensures you’re consistently building your savings, even if you forget.

- Invest Regularly:Utilize your app’s investment features to automate recurring investments in stocks, bonds, or mutual funds. This allows you to benefit from dollar-cost averaging and compound growth over time.

- Round-Up Feature:Some apps offer a round-up feature that automatically rounds up your purchases to the nearest dollar and invests the difference. This can be a simple and effective way to build your investment portfolio over time.

Improving Financial Literacy and Decision-Making

Personal finance apps can be valuable tools for enhancing your financial knowledge and improving your decision-making abilities.

- Educational Resources:Many apps offer educational resources, such as articles, videos, and quizzes, to help you learn about different financial topics.

- Personalized Insights:Some apps provide personalized insights and recommendations based on your spending patterns and financial goals. This can help you make informed financial decisions.

- Financial Planning Tools:Features like retirement planning calculators, loan amortization tools, and budget simulators can help you understand the long-term implications of your financial decisions.

Ultimate Conclusion

In today’s digital world, personal finance apps have become indispensable tools for managing our money effectively. By leveraging the features and insights these apps provide, we can gain control of our finances, make informed decisions, and work towards achieving our financial goals.

Whether it’s budgeting, saving, investing, or simply tracking our spending, the right personal finance app can empower us to take charge of our financial well-being and build a brighter future.

Essential Questionnaire

What are the best personal finance apps for beginners?

Mint, Personal Capital, and YNAB (You Need a Budget) are excellent options for beginners due to their user-friendly interfaces and comprehensive features.

Are personal finance apps safe?

Reputable personal finance apps prioritize security and use encryption to protect your financial data. However, it’s always wise to research an app’s security measures and read user reviews before sharing sensitive information.

Do I need to pay for a personal finance app?

Many popular personal finance apps offer free basic features, while premium versions with advanced functionalities often require a subscription fee.